I was watching the news on CBS a few weeks back (just like every night), and they had launched a new mini-documentary series called “Life and Debt”. The purpose of this series was to showcase three separate individuals who were all drowning under the pressure of their seemingly inescapable student loan debt. If interested, watch the episode on CBS, and you will garner all the sentimental, emotional appeal the news was trying to display. Nevertheless, “Life and Debt” was an all-too-real dive into how student loans are destroying the ability to create wealth for millions of Americans, spanning across multiple generations. However, it is still possible to graduate without student loans!

A few weeks passed, and I had forgotten all about the “Life and Debt” series until yesterday, when I read an article in the Wall Street Journal titled, “Playing Catch-Up in the Game of Life: Millennials Approach Middle Age in Crisis.” New data shows they’re in worse financial shape than every preceding living generation and may never recover. According to the article, the average net worth of households overall has grown, but young households have failed to keep up (even when adjusting for inflation). This is all occurring simultaneous to millennials becoming the most educated generation in world history, but they are deferring marriage, delaying home ownership, and not building wealth because of their student loans.

$1.5 Trillion Crisis

According to an article from Forbes, student loans have become a “$1.5 trillion crisis”, and the dramatic debt is capping innovation, holding back the economy, and leading to higher rates of depression. Everyone agrees there is a student loan crisis, but the question has become what to do about it. Some argue government intervention, while others suggest a market-based solution, but this is not an article about government policy; no, this is an article about leveraging personal responsibility to solve our own problems. Dave Ramsey says it best, “It doesn’t matter what happens in the White House unless we get our own house in order first”.

I will be approaching this problem based on schools in Iowa (since this is where I live), but these solutions work anywhere within the United States. So, here are 10 decisions you can make to ensure you avoid becoming part of the student loan crisis.

1. Attend a Public, In-State University

School choice is going to have a DRAMATIC effect on your cost of college! Attending a public, in-state university is the best way to ensure you receive the lowest tuition rates. For example, I attend the University of Northern Iowa where the tuition for an Iowa resident, upper-level business student was $9,407, but the tuition for the equivalent, non-Iowa resident was $19,949. This means that all non-residents are paying over 100% more in tuition to take identical classes.

Additionally, attending a private college is going to be even more expensive than an out-of-state, public school. For example, Creighton University in Omaha, Nebraska has business school tuition costs of $39,630. Now, some people might be wondering, “but isn’t the education at Creighton going to be better than the University of Northern Iowa?” Yes, I will concede the fact that, based on various college review sources, the overall education you receive from Creighton will be marginally better than at Northern Iowa, but is it 3x more valuable? Undoubtedly, no education from an accredited university is 3x more valuable than another accredited university (not even Harvard)!

2. Select a Low Cost of Living City

The cost of living between college towns can also vary substantially. Typical rent payments in Cedar Falls, Iowa (where Northern Iowa is located) approximate $400-450, while rent payments in Iowa City, Iowa (where the University of Iowa is located) approximate $650-700 a month. This “measly” $200 monthly rent difference results in a $9,600 difference when extrapolated over 4 years. Beyond just rent, cost of living includes food, entertainment, and other life necessities. Simply selecting a college in a less expensive town could save you $10,000 in college costs and graduate without student loans.

3. Live Lean

Time to be real with you for a second. If you are taking on student loans, you do not need to be living in the most expensive apartment complex and eating out at restaurants. Sorry to break it to you, but you might have to pass on the apartment complex with a pool, hot tub, and gym! Remember, you are broke! Those little luxuries here and there are going to bite you in the butt down the road. You’re a broke college kid, so live like a broke college kid (there really is no excuse).

4. Work

Every student needs to be working 15-20 hours a week during the school year and at least 40 hours a week during the summer. College costs money, and working is how you are going to pay for it! I am a big believer in cash-flowing your way through school. Studies have even proven that students perform better in school when they are working, compared to their counterparts who don’t work. I know this is true because it was exactly the case for me.

During my sophomore year at Northern Iowa, I was taking my most difficult accounting classes (Intermediate Accounting), and I was working 20 hours a week at John Deere. This was, by far, my busiest semester during college, and I honestly had no free time between work, school, exercising, and social relationships.

But, what were my results? I achieved my highest GPA throughout college (in the toughest courses), all while working 20 hours a week. Working and attending school forces you to be extremely efficient and diligent with your time and mature well beyond your peers. I have even had roommates work 40 hours and take a full course load, so I know it can be done.

If you work 20 hours a week during the 32-week school year and 40 hours during the 20 weeks of summer (for $11 an hour), you will make $15,840 for the year. Granted this is pre-tax, but there are also plenty of jobs paying more than $11 an hour (even McDonald’s is paying $11.50 in Des Moines). Being diligent and having a strong work ethic should yield you around $16,000 a year, and this should cover almost all your college expenses.

5. Be a Good Parent

This point is for all the parents. Parents, you need to have difficult conversations with your children about what schools they can afford. When I was 18, I thought I knew absolutely everything, and I desperately wanted to attend St. Louis University or Creighton University. My parents were courageous, and they told me I was not going to be attending those schools (effectively breaking my heart). If you have the money and want to pay for your kid’s college, I am all on-board with you spending your money however you choose.

At the time, I was extremely upset that my parents didn’t take me on campus visits to those schools, but looking back, I am so blessed my parents were looking out for me. I encourage all other parents to be actively involved with their child’s college decision selection and have those uncomfortable conversations. It will definitely save you heartaches in the long-run!

6. Work Hard in High School and Master the ACT

Your high school GPA and ACT score are going to be the two biggest factors when it comes to scholarship awards.

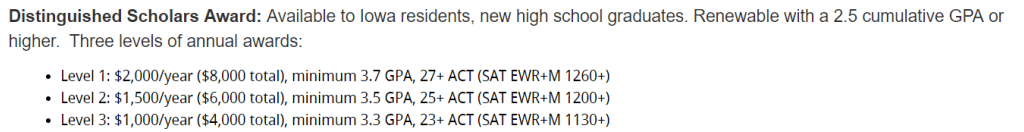

This scholarship structure of a GPA + ACT score = $xxxx is pretty standard across all universities in America. I personally took the ACT three times to achieve the score I wanted, but it paid off big-time! If you have a 3.3 GPA and got a 22 on the ACT, study and take the ACT again to shoot for a 23. This one point ACT increase could save you $4,000 in scholarships. “Cracking the ACT” by Princeton Review is the study guide I used, and it helped tremendously.

7. Consider Community College

There is absolutely no shame in attending a community college for two years, living at home, and then transferring to a 4-year university for your last two years. In fact, this strategy will save you A TON of money, and you get the EXACT SAME degree as someone who went to that school for all 4 years! The credit hours are about 50% cheaper, and you can use community college to take general education courses you must take regardless.

8. Graduate Early

Here’s a little secret: college should really only take you 3 years to complete! Yes, college should only take 3 years to complete, and you can do it too. I personally know many people who have graduated in 3 years (one friend even did it in 2.5 years)! The only reason I have not graduated early is because it takes 150 credit hours to sit for the CPA exam, which is effectively 5 full years of college (but I will still be done in 3.5).

So, how do you graduate early? You take dual-credit courses in high school, AP exams, and every summer/winter break class you can! Dual-credit courses are classes that count both towards your high school credits and college credits; I took dual-credit statistics, pre-calculus, biology, and physics, and they combined for 16 credits! Additionally, AP exams are another great way to earn college credits, and your high school doesn’t even have to offer the class in order to take the AP exam; I took and passed the AP Human Geography exam without ever taking the class. Finally, I have taken 4 classes over summer and winter breaks. Altogether, these credits have saved me 1.5 years of college!

By graduating early, you save all that money in tuition and living costs, and you can take a job to start earning money! This can result in a difference of $50,000-$70,000, and you will graduate without student loans.

9. Have an Honest Conversation with Yourself

Is college really right for you? In a Forbes Article, “The College Dropout Problem“, Frederick Hess articulates this exact point. “America has a college dropout problem. For all the talk of college costs and whether students can even afford to go to college, we’ve tended to skip past an equally crucial question—whether students who make it to campus are graduating with a useful credential. The sad reality is that far too many students invest scarce time and money pursuing a degree they never finish, frequently winding up worse off than if they’d never set foot on campus in the first place.

How common is this? In a word: very. In 2016, more than 48% of first-time, full-time students who started at a four-year college six years earlier had not yet earned a degree. For these schools, the four-year completion rate—that is, the share of students who complete a bachelor’s degree in the time the program is expected to take—is just 28%. Put another way, nearly 2 million students who begin college each year will drop out before earning a diploma. The picture at community colleges is no better. At public two-year colleges, only about 26% of full-time, first-time students complete their degree within three years.”

Starting and dropping out of college, for whatever reason, has EXTREME financial consequences; you are still straddled with your student loans even though you might not have a college-educated income to pay them back. It is hard to graduate without student loans if you never graduate!

10. Know What You Will Do After College

There is really only one true point of college, and that is to receive an education and training that enables you to provide value within the economic marketplace. You should not wander into college without a purpose; I’m not saying you need to know exactly what you want to do for the rest of your life, but you should be able to narrow down on a specific area of study (business, science, etc). The Bureau of Labor and Statistics posts salary information for essentially every major occupation in the United States, so there is no reason you “have no idea” how much money you will make upon graduation.

Graduate Without Student Loans

If you follow all of these steps diligently, I guarantee you will avoid the student loan crisis. It is time we start taking personal responsibility for our actions and solve our own problems!

The Sound Mind Blog Series is intended for SigEp brothers to explore their own academic or intellectual interests while developing the minds of others. SigEp subscribes to the ancient Greek belief that the mind is central to humanity and thus the exercise of the mind is necessary for a balanced life. Developing a sound mind means living a lifestyle that allows you to expand your mind inside and outside of the classroom setting.

Meet the Author

Alex Smith ’19

Accounting & Finance Major

Retreat & Intramural Chairman