*Special thanks to Dr. Ken McCormick for reviewing this blog post and inspiring me to write on the History of Economics and the Diamond-Water Paradox*

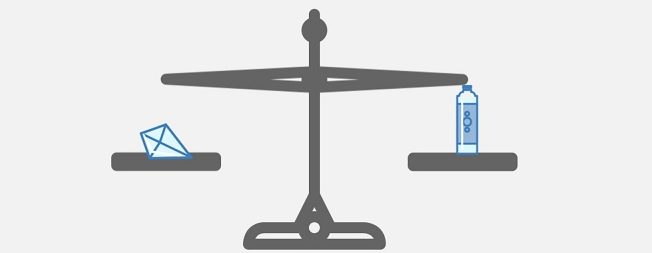

If you had the choice right now between a gallon-sized container full of water or a gallon-sized container full of diamonds, which would you choose?

I am confident that most people would choose the container full of diamonds.

This decision seems to be obvious.

When analyzing this choice deeper, it seems not to make sense that most people would choose the diamonds. Water is essential to life. It is common knowledge that 60% of our body is made of water and that water is a basic human need. On the other hand, a diamond has no value for prolonging human life. Any human could live their entire life without even knowing what a diamond is and still survive. But still, people would choose the diamonds over the water.

Out of this, the diamond-water paradox is born. Throughout the world, diamonds are more valuable than water, even though water is a necessity. This preference is reflected because someone could buy a gallon of water at any grocery store in the country, but only very special stores have diamonds, which are placed behind secure cases and in vaults. It is an undeniable fact that water is a basic human need, while it is also undeniable that one diamond can cost more than hundreds or even thousands of gallons of water.

Economists take special notice to this case, as they are commonly concerned with value and what determines the value of any good. I am a Junior economics major and have recently explored this fascinating paradox in great depth through a History of Economics course, so for my sound mind blog addition, I wanted to explore the diamond-water paradox. There is no definitive answer to the exact reasons for this paradox, as there is no definitive answer to the question of what determines a good’s value. For this blog post, I will explore this idea through famous economists, such as Adam Smith, David Ricardo, Karl Marx, Alfred Marshall, William Stanley Jevons, and Thorstein Veblen.

This paradox was first presented by Adam Smith (1723-1790), who is also known as the “Father of Economics.” In his most famous work, “An Inquiry into the Nature and Causes of the Wealth of Nations,” which is better known as ‘The Wealth of Nations,’ Adam Smith brought up the issue. Smith argued the cost of production determines value. Thus, diamonds cost more than water because they are more expensive to produce.

David Ricardo (1772-1823) was a firm believer in The Labor Theory of Value (LTV). The LTV is the idea that a good’s value and price are determined by how much labor it takes to create it. When the LTV is applied to the diamond-water paradox, it is clear why diamonds would cost more than water. It takes more labor to mine rough diamonds, and then refine and cut them into finished diamonds than it does to go to a lake and get a cup of water, for example. While there is a production process involved in taking water from a natural source and making it clean, compared to all the time and labor that is necessary to create a diamond jewel, Ricardo’s labor theory of value explains why a diamond would cost more than water even though a diamond is unnecessary to sustain life like water.

The infamous Karl Marx (1818-1833), while better known as a revolutionary, was also a prominent economist of his time. Like Ricardo, Marx was an advocate for the Labor Theory of Value, but with a twist that focuses on surplus value. This is Marx’s idea that profit comes from a worker’s ability to create surplus value. Marx believed that surplus value comes from the exploitation of labor by capitalists. The exploitation of laborers creates surplus value because workers can create value enough to pay for their service in a fraction of the time of a typical workday. Although the workers can produce the value of their labor costs in a shorter period, capitalists will use their labor longer to increase the value produced, the surplus value.

Following this logic to the diamond water paradox, since it takes a lot of labor to mine and craft a fine diamond jewel, the time spent in production adds significant surplus value to what was once a rough diamond, an undesirable looking rock. While there is a production process involved in taking water from a natural source and making it clean, compared to all the time and labor necessary to mine and prepare a diamond for sale, Marx’s labor theory of value supports why the diamond water paradox exists.

Marginalist economists such as William Stanley Jevons (1835-1882) and Léon Walras (1834-1910) argued that marginal utility determines the value of a good. In economics, utility is a synonym for happiness or pleasure. Marginal utility then is a measure of how much happiness an additional unit of a given good can provide someone. A good with a higher marginal utility will subsequently have more value to an individual and have a higher price in the market. In terms of the diamond water paradox, the reason diamonds cost more than water is that one additional unit of diamonds would provide more utility than one additional unit of water. Even though water is more valuable because of its ability to sustain life, on the marginal level it is not near as valuable.

Alfred Marshall (1842-1924) is considered the father of neoclassical economics, which is the dominating thought in the field today. He argued both supply and demand determines price. Water is necessary for life, but its supply is (generally) high relative to demand, so its price is low. On the other hand, the supply of diamonds is quite small relative to demand, so their price is quite high.

While not as famous as Smith or Marx, I think the ideas of Thorstein Veblen (1857-1929) are still worth mentioning. Thorstein Veblen was an American sociologist and economist who is most famous for the idea of conspicuous consumption. Veblen believed that people place significant emphasis on their social status when making decisions in the market, and frequently will prioritize gaining status over fulfilling their needs. This comes into play with conspicuous consumption, which is the idea that people will make consumption choices solely to display their wealth, and will view the ability to showcase their status as a potential benefit to be gained when buying a good. Diamonds are a perfect example of conspicuous consumption. Diamonds have no real use other than to be worn and to display an individual’s ability to have diamonds and the status associated with being able to have enough wealth to buy a good with no use value. Having water does not display wealth; it is very common to find water for free in water fountains in most buildings. Under this idea, diamonds are immensely more valuable because of their ability to showcase wealth, and are precious under the idea of conspicuous consumption. In this view, diamonds are desirable because they are expensive and have no practical use.

There are many ways to approach the diamond-water paradox, and it serves as a great example to discuss the theory of value in economics. Determining a good’s value is a complex issue and one that I am sure economists will continue to wrestle with for the foreseeable future. In my eyes, there is a way to explore the diamond-water paradox in real life. If you are ever proposing to a significant other, try swapping out the diamond ring for a glass of water and explain to them how in theory water is much more valuable than any diamond because of its ability to sustain life. I imagine their reaction will instill that indeed the diamond-water paradox exists in practice, and is a significant factor to consider when thinking about economic value.

The Sound Mind Blog Series is intended for SigEp brothers to explore their own academic or intellectual interests while developing the minds of others. SigEp subscribes to the ancient Greek belief that the mind is central to humanity and thus the exercise of the mind is necessary for a balanced life. Developing a sound mind means living a lifestyle that allows you to expand your mind inside and outside of the classroom setting.

Meet the Author

Meet the Author

Hugh Zehr ’21

Economics major and Music minor

President